Understanding what is flood zone AE in Florida is key for any homeowner or buyer. This zone, defined by FEMA, shows areas with a high risk of flooding and specific elevation rules. Many Florida homes fall in AE flood zone, which can affect insurance costs, building codes, and resale value. Knowing the flood zone AE meaning helps you plan better, avoid costly repairs, and meet legal requirements. Whether you’re checking your FEMA map, applying for a mortgage, or building a new home, this guide explains the essentials of flood zone AE Florida. Let’s dive into the meaning, risks, and requirements of this crucial flood zone.

Flooding is a serious concern in Florida. With its low elevation and frequent storms, many properties fall under different FEMA flood zones. One of the most common and important zones is Flood Zone AE. If you’re buying, building, or living in Florida, it’s important to understand what is flood zone AE in Florida, what it means for your home, and how it impacts insurance and building rules.

This zone plays a critical role in determining your flood risk and financial planning. Knowing the rules and definitions related to AE flood zone Florida can protect you from unexpected costs and help you make smarter housing decisions. Let’s explore it in detail.

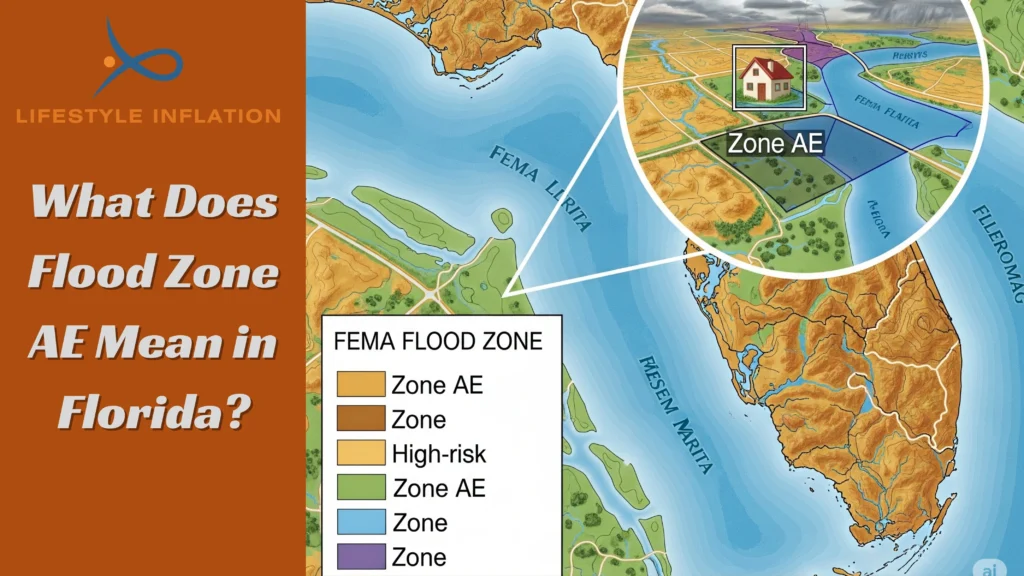

What Does Flood Zone AE Mean in Florida?

In Florida, Flood Zone AE is one of the highest-risk zones listed by FEMA. It refers to areas that have a 1% annual chance of flooding, often called the 100-year flood. These zones are shown on flood maps with specific elevation data. That’s why the flood zone AE meaning often includes both location and height above sea level.

The zone AE flood meaning also tells insurers and builders how much risk is involved. It helps decide how high a home must be built and what kind of flood zone AE insurance is needed. In short, the ae flood zone meaning is all about managing water danger with smart rules. For long-time residents and new buyers alike, understanding this label could be the key to protecting your biggest investment.

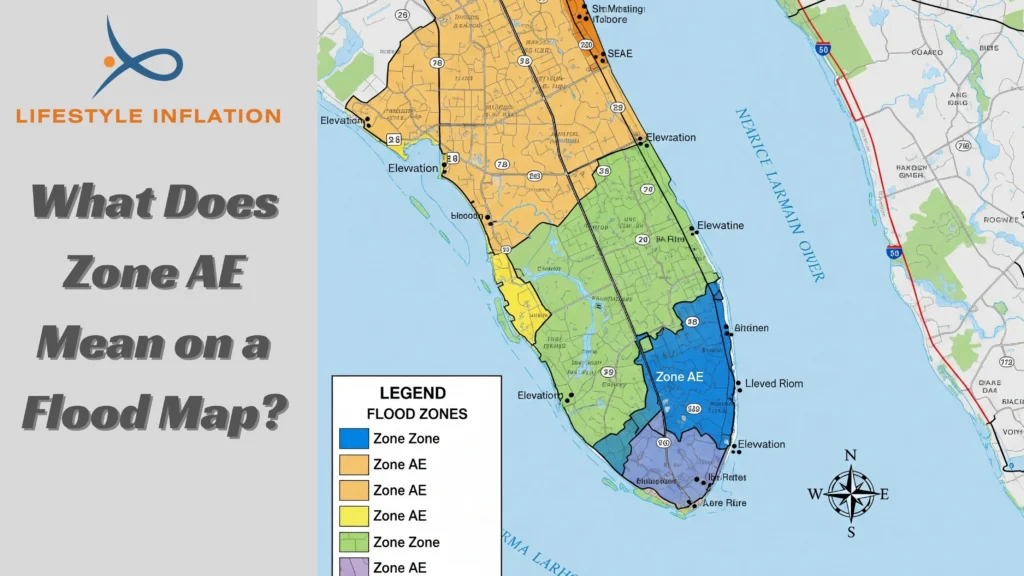

What Does Zone AE Mean on a Flood Map?

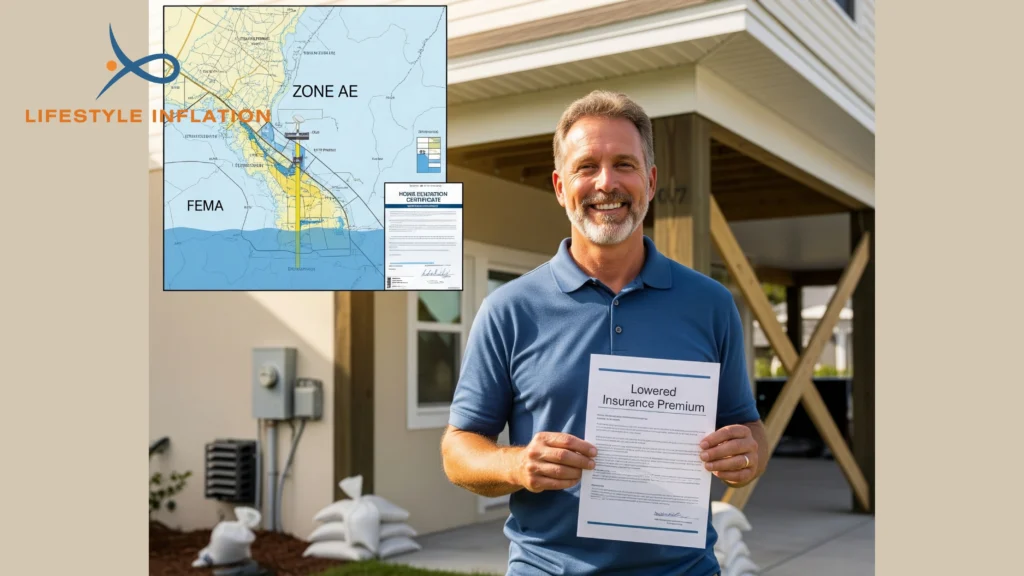

A FEMA flood map shows AE zones using shaded areas and base flood elevation numbers. When you see “AE” on a flood map, it means the land is at risk of flooding during a major storm. These maps also list the spatial flood zone code AE, which includes important data like depth of water and BFE.

Understanding what does zone AE mean on a flood map helps buyers and developers make smart choices. FEMA updates these maps every few years. You can check your flood zone AE Florida status at msc.fema.gov. In fact, the accuracy of this information can determine whether a property remains affordable in the long run or not.

Is Flood Zone AE in Florida Bad for Homeowners?

If you live in an AE zone, it doesn’t mean your home is unsafe. But yes, there are higher risks. Is flood zone AE bad? For insurance costs and repair risks, it can be. You may face flooding even from minor storms if the drainage is poor. The condition of nearby stormwater systems also plays a role in how serious those risks are.

Is AE flood zone bad? It depends. Many homes in Florida are built to strong codes that reduce flood damage. Still, you’ll likely pay more for flood insurance for zone AE, and some upgrades may be needed to meet safety rules. For homeowners on a budget, these expenses could make a noticeable difference in yearly costs.

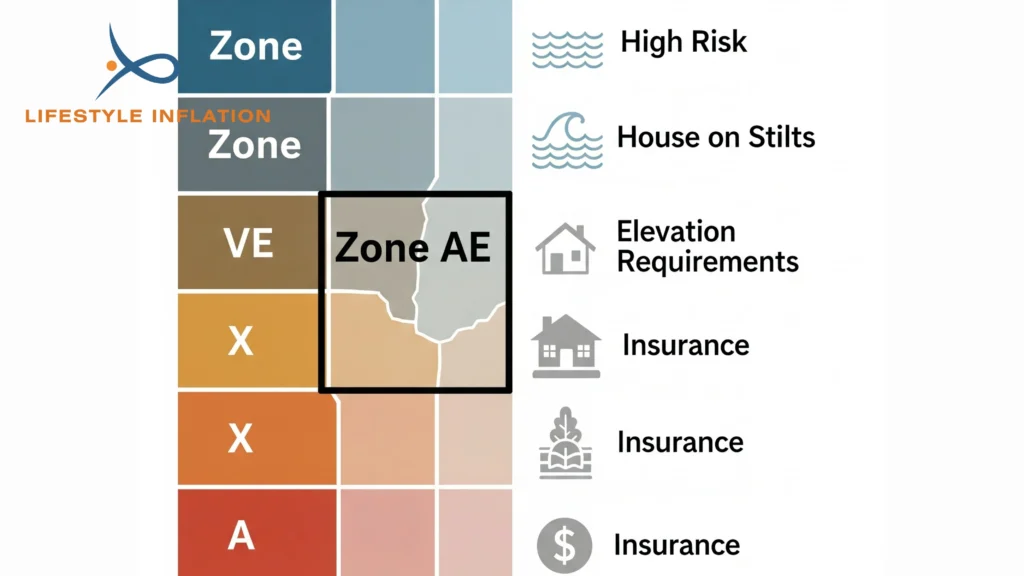

AE Flood Zone vs Other Zones: What’s the Difference?

AE flood zone is different from other zones like X, A, or VE. For example, Zone X has minimal risk and usually doesn’t need insurance. VE zones are coastal and face wave risks. But AE has known flood elevations, making it more specific and easier to plan for.

This table compares AE to other common zones:

| Zone Code | Flood Risk Level | Insurance Required | Elevation Data |

|---|---|---|---|

| AE | High | Yes | Yes |

| A | High | Yes | No |

| X | Low | No (unless lender requires) | No |

| VE | Very High (Coastal) | Yes | Yes |

So, if you’re wondering what is zone AE flood zone, it’s a high-risk area with clearly defined flood height data. These differences affect how properties are valued, how structures are built, and how insurance is calculated.

Does Flood Zone AE Require Flood Insurance in Florida?

Yes, most homes in flood zone AE in Florida do require insurance. If your mortgage is backed by the government, it’s mandatory. That’s because flood zone AE require flood insurance under FEMA’s National Flood Insurance Program (NFIP). Many private insurers also require coverage due to the known risks.

Even if not required, buying flood zone AE insurance is wise. FEMA says just one inch of water can cause over $25,000 in damage. So, does AE require flood insurance? Almost always yes—especially if you want financial protection. This added layer of security may feel like a burden now but becomes a blessing during disaster recovery.

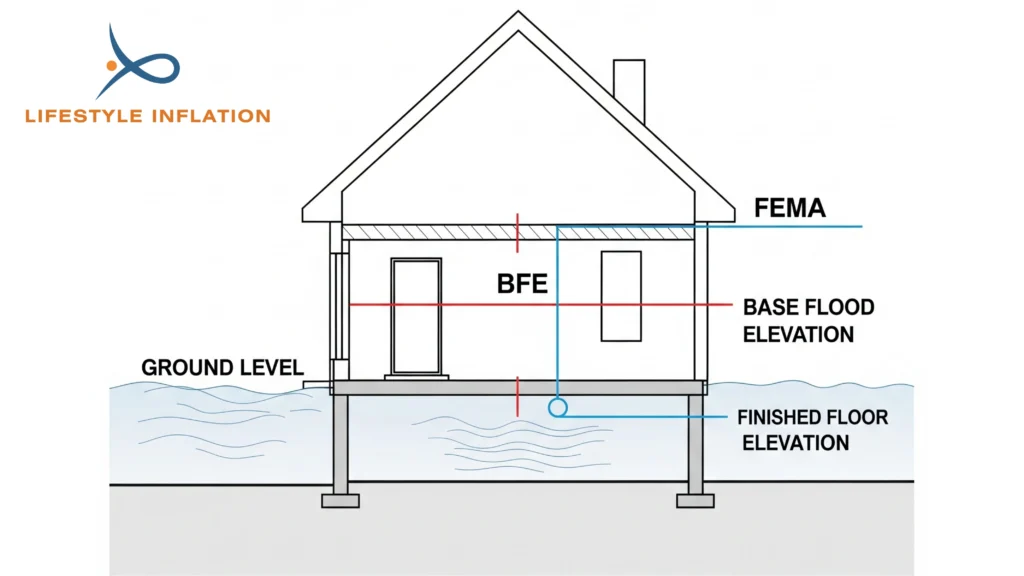

Understanding Base Flood Elevation (BFE) in Zone AE

The base flood elevation zone AE is a number given by FEMA to show how high water may rise. In AE flood zone Florida, homes must often be built above this level. It’s called elevation compliance. Builders must follow this elevation closely to reduce damage and insurance cost.

For example, if the BFE is 9 feet and your house sits at 7 feet, you’ll need to elevate it. Meeting this number not only protects your home but also reduces flood zone AE insurance costs. Properties that don’t follow BFE regulations may face higher premiums or even difficulty in obtaining insurance coverage.

Building in Flood Zone AE: Florida’s Requirements and Regulations

Building in flood zone AE requirements include elevating the home above the BFE, using flood-proof materials, and securing utilities. Florida building codes also demand strong foundations that can resist water damage. Engineers often recommend raised foundations, sealed lower floors, and storm-ready drainage systems.

Can you build in flood zone AE? Yes, but only after meeting these rules. Failing to follow them can lead to denied permits or high insurance rates. Always check your local rules before starting any project in a floodzone AE. Working with a qualified contractor and an architect who knows flood zone design can also make the process smoother.

How to Save on Flood Insurance in Florida’s Flood Zone AE

There are smart ways to lower your flood insurance for zone AE. Elevating your home, installing flood vents, and getting an elevation certificate can all help. Some communities also offer discounts through FEMA’s Community Rating System, which rewards flood mitigation efforts.

Another tip is to avoid past claims. Insurers charge more for high-risk properties. By reducing risk and improving drainage, you can make your flood AE home safer and cheaper to insure. Adding smart landscaping, keeping gutters clear, and upgrading stormwater systems are simple steps that yield long-term savings.

Buying a Home in Flood Zone AE in Florida: What to Know

If you’re buying a house in flood zone AE, start by asking for the elevation certificate and the flood history. Also, ask your lender if flood zone AE insurance will be required and what it might cost. A professional home inspection can help spot any issues related to previous flooding.

Choose a realtor who understands zone AE flood laws and FEMA rules. Knowing what is AE flood zone in Florida can save you from surprises later, especially during storms or inspections. Doing this homework early prevents regrets after signing the papers.

FEMA Flood Zone AE: How to Check Your Florida Property’s Status

To check your FEMA flood zone AE meaning, go to FEMA’s Flood Map Service Center and enter your address. You can also contact your local county floodplain manager or building department.

These maps list flood zone code AE, BFE levels, and nearby waterways. This info helps you find out if you’re in 9AE flood zone, 8AE flood zone, or another related AE zone. Keeping up with map updates also ensures you meet insurance and permit standards.

Final Thoughts: Is Flood Zone AE a Deal Breaker?

Living in a Zone AE flood area isn’t a deal breaker. With proper planning, flood insurance, and elevated construction, it can still be a safe and smart choice.

If your floors are affected by flooding, restoring them can be simple. Here’s a helpful step-by-step guide to painting linoleum floors to refresh your space affordably.. If you understand what is flood zone AE in Florida, you’re already ahead of the curve. The more proactive you are now, the fewer problems you’ll face later. doesn’t mean you should avoid the property. With the right flood zone AE insurance, elevated structures, and smart planning, it’s safe and manageable. Many Florida residents live happily in Zone AE flood areas with little to no flooding thanks to proper construction.

Just remember: knowledge, preparation, and compliance are your best tools. If you understand what is flood zone AE in Florida, you’re already ahead of the curve. The more proactive you are now, the fewer problems you’ll face later.

FAQ’s

Does flood zone AE in Florida require flood insurance?

Yes, flood zone AE in Florida requires flood insurance if your home is financed through a federal mortgage. Even if not required, it’s strongly recommended due to the high flood risk.

What are the worst flood zone codes?

The worst zones include VE, A, and AE, with VE being the most severe due to coastal waves. These zones carry the highest flood risk.

What is the lowest flood risk rating?

Zone X (unshaded) has the lowest flood risk and doesn’t usually require insurance. It’s ideal for buyers seeking safer areas.

What are the levels of a flood?

Floods are categorized as minor, moderate, or major. These levels depend on water height and damage potential.

What are the 4 phases of a flood?

The four phases are precipitation, accumulation, inundation, and recession. Each stage helps understand how floods build and fade.